Discover which U.S. state is financially toughest to live in, why high costs matter for medical tourism, and practical steps to ease the burden.

Read MoreState Tax Burden

When talking about state tax burden, the total amount of taxes a resident owes to a state, including all levies on income, property, sales, and other activities. It’s also known as state tax load. This burden encompasses income tax, tax on wages, salaries and other earnings, property tax, tax based on real‑estate value and sales tax, tax applied to retail purchases. Reducing the state tax burden often means learning about tax deductions, expenses the tax code lets you subtract from income and tax credits that directly lower what you owe. In short, the bigger picture is that a high state tax burden can affect everything from paycheck size to home‑ownership costs.

How Different Factors Shape Your Tax Load

One major driver of the state tax burden is the structure of income tax rates. States with progressive brackets may pull more from high earners while offering relief to lower‑income households. Yet, even a flat‑rate state can feel heavy if other levies, like property tax, are steep. For example, a homeowner in a high‑value market might see property tax alone consume a sizable share of their annual expenses, pushing up the overall burden. Sales tax adds another layer; states that rely heavily on consumption taxes often have lower income taxes, but everyday shoppers feel the pinch at the register. Meanwhile, tax deductions and credits act as counterweights—deductions lower taxable income, while credits slice directly into the amount owed. Understanding which deductions apply—such as those for medical expenses, education, or home energy upgrades—can dramatically shift the net burden.

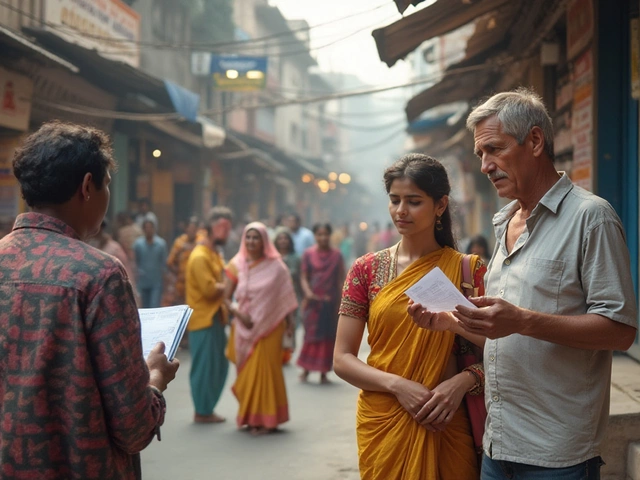

All of this matters because the state tax burden directly intersects with other cost categories, especially healthcare. Medical tourism, prescription costs, or even routine doctor visits can be influenced by how much disposable income remains after taxes. A family facing high state taxes might find it harder to afford out‑of‑pocket health expenses, prompting them to explore cheaper options in other states or countries. The set of articles below reflects that reality: they cover everything from the price of IVF in different U.S. states to affordable alternatives for diabetes medication, revealing how tax environments shape real‑world health spending. As you scroll through, you’ll see practical tips, cost‑saving strategies, and clear explanations that help you navigate both your tax landscape and your health budget.